How Agents Are Changing to Capture Younger Life Insurance Customers

By: Olivia Overman

Nearly three-quarters (72%) of Americans overestimate the true cost of a basic term life insurance policy, with younger Americans likely to think it is three times its actual cost, according to the “2024 Insurance Barometer Study” by LIMRA and Life Happens. When asked how they came up with their life insurance cost estimate, more than half of respondents (54%) said it was based on “gut instinct” or a “wild guess,” the report says.

Nevertheless, “although many do overestimate the cost of life insurance, among younger Americans, LIMRA’s ‘2023 Insurance Barometer Study’ also found that Generation Zers and millennials express greater concerns around financial stability and providing for their family than older generations do,” says Rob Schaffer, head of product, individual life insurance, Prudential. “The desire for greater protection is there, despite any potential knowledge gap.”

However, not knowing how much or what kind of life insurance to buy is more likely to stop someone from purchasing coverage. For independent insurance agents, capturing the underserved life insurance market of young consumers and keeping apprised of their needs can open up opportunities.

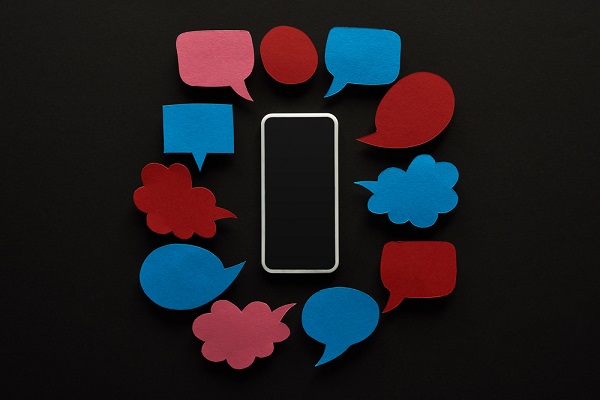

With the younger generations, “not only is it their perception that life insurance is more expensive than it really is, you have to educate them on the need for the coverage,” says Holly Snyder, president of life insurance, Nationwide. “And you have to provide a process for purchasing it that actually allows them to not be inconvenienced because, of course, their whole life is on their phone.”

With changing technology, “some of today’s life insurance search tools allow customers and their agents to more easily find coverage that fits their budget,” Schaffer says. “Thanks to rapid innovations in digital platforms, the life insurance industry continues to make the purchase processes simpler with many different types of life insurance products more accessible than ever. In many cases, medical exams may not be necessary, depending on the policy face value, and customers can often acquire coverage in just a few days.”

“The industry is in a time of change where we are looking at simplified experiences and solutions designed to ultimately expand access for all kinds of customers,” Schaffer continues. “Technology is playing a large role in that shift. We’re seeing rapid innovations in digital platforms that optimize automation and data-driven insights.”

By shifting their business model to take advantage of online resources, agents can provide the education needed to capture new customers. After all, customers are not going to buy what they do not understand. Leveraging social media to provide accurate information opens up that gateway for agents.

Importantly, 60% of Gen Zers seek financial advice on YouTube, 53% on Instagram and 41% on TikTok, according to the LIMRA “2023 Insurance Barometer Report,” and insurance agents can help ensure that information acquired here is accurate as well as readily available.

“For many carriers, I would call it experimentation right now,” Snyder says. “We’ve got a whole list of diverse influencers to help close some of the gaps between education relative to the need for life insurance. And this goes back to us experimenting and trying different things to be able to reach and attract that audience because we know they would not necessarily be going through the traditional route of our financial professionals.”

However, social media marketing and education is just the beginning. “That simplified digital experience must stand the test of time throughout the customer’s entire journey,” Schaffer says. “To truly move the needle, this must include streamlining the underwriting and processing system.”

As an industry, “we’ve got to continue not only with educating about the need and what the cost is, but continue to invest in the process to make it as easy for them to buy something that none of us want to spend a lot of time thinking about and just want the peace of mind to check the box and get back to having fun in life,” Snyder says.

Olivia Overman is IA content editor.