More than $600 million in premium and 160 active insurers—a nice start to private flood. Where is this line of business most prevalent and which insurers are focused on it?

More than $600 million in premium and 160 active insurers—a nice start to what is often cited as an “uninsurable risk." As private flood insurance approaches the $1 billion direct written premium level, I have to say I'm impressed.

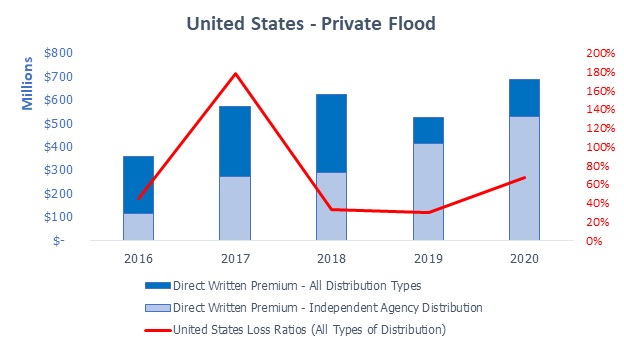

I was surprised by the premium, the growth and the relative profitability of the market. Below is a five-year summary of national direct written premium and losses for private flood insurance.

The graph accumulates all insurers in U.S. states for direct written premiums in private flood and the federal write-your-own (WYO) flood program. The average growth rate for private flood is 17.5%, the loss ratio is 72%, translating into a 98% combined ratio. For a new line of business, that seems remarkably good. Many insurers would like to see that combined ratio in commercial auto, which has a five-year loss and combined ratio of 68% and 106%, respectively.

Source: © A.M. Best Company

So, out of the total provided visually above, where is this line of business most prevalent and which insurers are focused on this business?

Fortunately, insurers are required to provide their direct written premium, losses and even commissions for any state they write any premium, which means all that information is available via recently filed insurer annual reports with their state regulator. That shows up on what is called Statutory Page 14, or “the state's page" in their annual report.

Below are the 10 states that write the most direct written premiums for private flood and the federal WYO flood program.

| State | Private Direct Written Premiums | Federal Direct Written Premiums | % Private |

| Florida | $115,245,000 | $890,138,000 | 11% |

California

| $74,594,000

| $395,686,000 | 16% |

Texas

| $62,033,000

| $267,317,000

| 19% |

New York

| $54,084,000

| $179,296,000 | 23%

|

| New Jersey | $33,169,000

| $173,507,000 | 16% |

| Pennsylvania | $20,554,000 | $144,464,000 | 12% |

| Illinois | $19,865,000 | $124,476,000 | 14% |

| Louisiana | $19,017,000 | $85,634,000 | 18% |

| South Carolina | $18,738,000 | $65,492,000 | 22% |

| Massachusetts | $17,013,000

| $63,140,000 | 21% |

Source: © A.M. Best Company

You might guess the correlation to federal flood premiums and private flood premiums is high—and it is. The amount of private flood insurance in a state to federal flood is 94%. But perhaps the most surprising figure is the portion of all flood premiums written in the private market. It barely existed 10 years ago but in 2020 the average of the top ten states is a ratio of 15% private to 85% federal.

As far as the top insurers, you can see them in the table below. Provided is the insurer name, the group to which each belongs, some information on the types of licenses the insurer carries, as well as the predominant marketing type the insurers use to describe their distribution.

| Insurer Name | Insurer Group | Licensing Summary | Marketing Type |

| American Security Insurance Company | Assurant P&C Group | Admitted (50), E&S (0) | Direct Response

|

| Zurich American Insurance Company | Zurich Insurance US PC Group | Admitted (51), E&S (0) | Independent Agency |

| Arch Specialty Insurance Company | Arch Insurance Group | Admitted (0), E&S (51) | Broker |

| XL Insurance America, Inc. | XL Reinsurance America Group | Admitted (51), E&S (0)

| Independent Agency |

| AIG Property Casualty Company | American International Group | Admitted (50), E&S (0) | Broker |

Westport Insurance Corporation

| Swiss Reinsurance Group | Admitted (51), E&S (0) | Direct Response |

| Voyager Indemnity Insurance Company | Assurant P&C Group

| Admitted (1), E&S (50) | Direct Response |

| Employers Insurance Company of Wausau | Liberty Mutual Insurance Companies | Admitted (51), E&S (0)

| Direct Response, Broker |

| American Guarantee and Liability Ins Co | Zurich Insurance US PC Group | Admitted (51), E&S (0) | Independent Agency |

| Indian Harbor Insurance Company | XL Reinsurance America Group | Admitted (0), E&S (51)

| Independent Agency |

Source: © A.M. Best Company

Based on the top 10 insurers and the licenses they hold, it would appear that about 60% of this business is done on a surplus lines basis.

So what does the future hold for private flood? Time will tell but private flood does appear to have made substantial in-roads on the overall flood insurance marketplace.

Paul Buse is principal, founder and owner of Real Insurance Solutions Consulting.

This Student of the Industry article is part of a monthly column on IAMagazine.com. Keep an eye on Thursday's weekly News & Views e-newsletter in July for the next off-beat take on current trends in the insurance industry.