With the cannabis insurance industry blazing ahead, learn how to study the smoke signals to determine if and when your agency should pursue this budding line.

The cannabis insurance industry is a niche marketplace that is new and growing quickly. Whether or not your agency is ready to offer cannabis insurance, it's a good idea for all students of the industry to learn more about the market as it evolves in your state.

One trick I learned from my risk management consulting days is when looking at an industry I am not familiar with, look at the insurance filings for that business. It is, perhaps, an indirect approach to understanding the business risks, but the advantage is that one can stand on the shoulders of the very astute observers of that industry—those that underwrite it.

So, how do you do that?

Well, knowing that California was the first state in the nation to legalize cannabis, I went to the California Department of Insurance to see what was publicly available. California state insurance regulators usually make insurer filings available for public viewing.

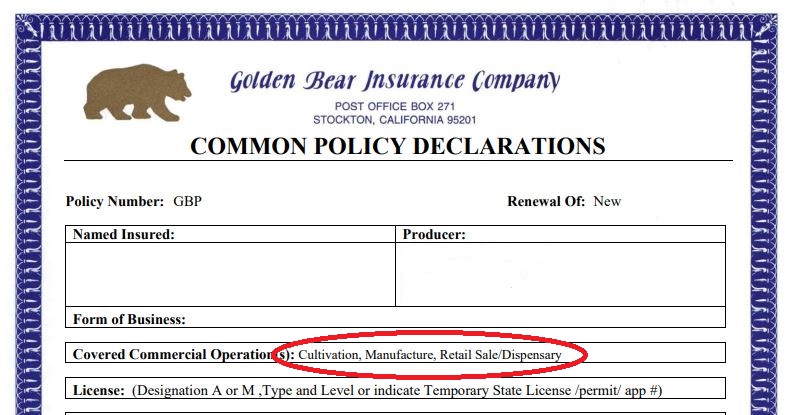

I found two filings of interest. The first was by an industry advisory organization, the American Association of Insurance Services (AAIS). The second was by a California-based insurer, Golden Bear Insurance Company. The former allows insurers that subscribe to their services to use those forms as filed. The latter actually underwrites and takes on the cannabis risk.

Source: California Department of Insurance web access to rate filing forms.

Looking at filings, one can learn a lot. Underwriting and rating guides talk about eligibility, rating methods and surcharges. Policy forms show coverages and limit options. Endorsements shed light on optional coverages or troublesome risk areas.

So, let us turn to the Golden Bear filing. I now know, for example, that insuring cannabis plants is treated as “stock" and coverage is limited on a per plant basis. Harvested plants are insured by the pound (up to $500 per pound) and flowering plants are insured by the plant for one value, for typical plants, while “mother plants" (clone producers) can be insured for five times as much.

Of course, my point is not those facts in particular—as they are perhaps overly specific—but rather to show the sort of insights you can glean from looking at filings.

More telling is what I did not see: more insurer filings. It struck me, if an insurance niche is well known and active in our largest state for years and only one insurer is publicly filed to write it, insurance and risk management is being done somewhere else.

In searching published articles on cannabis insurance, I found that is exactly what's happening. Most of the coverage is reported by agents and specialty wholesalers to be covered by non-admitted—surplus lines or excess & surplus—insurers.

Ricardo Lara, California insurance commissioner, is even on record stating he looks forward to more admitted insurers so he can oversee that business, rates and practices better.

I agree and here's why.

Below is a portion of the declarations page filed with the Golden Bear filing. You can quickly see it's based on a standard business owners policy. Available for purchase is a combination of property, general liability and crime coverage with typical language and wordings. These are all important coverages for a business like a dispensary.

On an E&S basis, however, that package can quickly become five non-standard policies. Premises liability, products liability, standard property, inland marine or crop, and crime. And that's before you consider an umbrella policy from an unrelated insurer sitting on top of separate premises liability, products liability and auto liability.

The E&S approach, while critical to managing risks, is just less efficient, more prone to errors and subject to gaps and overlaps between the policies.

The last thing I learned in this investigation is that if you are not yet placing this coverage, do not panic. You have time to study this. The errors & omissions risk of this business is a consideration—so be careful.

To help you understand the market size and that a cautionary approach is wise, let's look at the numbers. Below makes the case that the insurance market today is relatively still modest. A niche. It's growing quickly, so get ready if you have any interest in it—but be sure you have time to be thoughtful about it.

| Cannabis Marketplace Worksheet |

| |

| Cannabis dispensary sales (#1) | $20.1 billion | Average sales are $18.6 to $21.6 billion in U.S. |

Production multiplier (#2)

| 2.5 | For $1 of dispensary sales, assume, $1.5 additional dollars of cannabis-specific activity for a 2.5 multiplier of retail sales to all cannabis-related revenue |

| Cannabis-specific exposure (#3) | $50.2 billion | (#1) x (#2): This is all activity underwriters would see as "cannabis-related" and this would include final dispensary sales but also growing, processing and transportation |

| Cannabusiness cost of insurance (#4) | 3% | Big business insurance is generally about 1% of revenues. Small businesses can multiples of that—here I'm using 3 times the average, or 3%. |

| Cannabis property-casualty insurance marketplace | $1.5 billion | (#3) x (#4): This is estimated premiums for package, workers compensation, umbrella and other insurance on cannabis-related businesses |

To put the above figures into perspective, at $1.5 billion in premiums and assuming an average agent commission of 11.5%, that is commission revenues of $4,500 for each of the 38,000 independent agencies in the U.S. Of course, $4,500 is not a trifling amount.

However, seeing that revenue figure and knowing an average agency E&O policy is a similar amount, that makes the point that being cautious is wise. I have seen many agents E&O insurance cost double when underwriters are concerned about that agency's exposure. If that happened to your agency, the upside and downside are very close to each other. It's a good idea to go into the new niche with diligence and study.

Paul Buse is principal, founder and owner of Real Insurance Solutions Consulting.

This Student of the Industry article is part of a monthly column on IAMagazine.com. Keep an eye on Thursday's weekly News & Views e-newsletter in May for the next off-beat take on current trends in the insurance industry.