Student of the Industry: Do Insurers Have Two Sets of Books? Is that Legal?

By: Paul Buse

The answers are “yes” and “yes.”

The concept of insurers using “two sets of books” jumped out at me recently in two instances. First, several months ago when Cincinnati Financial released their first quarter financial results: a net income loss of over $1 billion. Three months later it jumped out at me again, when Cincinnati released its second-quarter FY2020 results that showed a nearly $1 billion positive net income. That $2 billion swing in net income in two quarters got my attention.

When I looked up their results based on data filed with their regulators via A.M. Best, the results are not nearly so drastic. Rather than a $1 billion net income loss in the first quarter, there was a $64 million gain in the first quarter. In the second quarter, it was $54 million net income and nowhere near the $1 billion gain reported in the trade press and their quarterly financial release.

What’s the difference?

The difference is accounting rules. Specifically, Generally Accepted Accounting Principles (GAAP) as opposed to Statutory (STAT) accounting rules. These rules can vary and create big differences in results. This is one of those instances.

The focus on GAAP accounting used in announcements to stockholders and press releases is more of an investor-view. That view tends to focus more on both underwriting income and loss, as well as a current snapshot of what is happening with investments of the insurers.

The focus of STAT accounting is more on the ability of insurers to pay claims. This is primarily what state insurance commissioners think about. Of course, the investment performance of insurers enters a regulator’s consideration of an insurer, but it is less focused on short-term changes in unrealized investment values.

That brings us back to Cincinnati and those large swings in net income reported in their quarterly financial releases, which was reported in GAAP. As agents and students, you should know that whether you are looking at GAAP or STAT, you should be aware of what is included in the net income of an insurer’s financial report.

This is important right now as insurers are reporting their financial results—and everyone is very curious about the impact of COVID-19 on those results. Concurrently, the stock market has been highly variable. When insurers invest more in stocks, it also impacts their financial results.

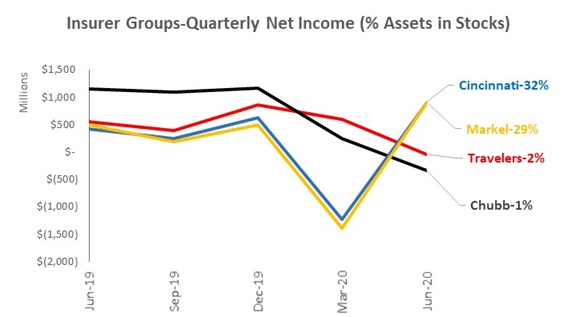

Below is a summary of the quarterly net income as reported by four insurer groups to their stockholders.

Source: Yahoo! Finance

Two insurers invest heavily in stocks and the other two invest very little in stocks. The percentage of each insurer group’s investments in stocks to their total assets is shown as percentages. For example, Cincinnati Financial has 32% of its assets invested in stocks.

As stock values decreased and then increased dramatically in market value from March to June, you see that reflected in the reported net income of two of the insurer groups. Again, that would be GAAP. The other two insurer groups did not invest heavily in stocks so their income appears less volatile.

Does this make sense? Yes it does. It’s apposite, actually.

When investors look at financial results, they want to know how the insurers they own shares in are doing. Seeing this reflected on the insurer’s income statement makes sense to them.

With statutory accounting and insurance regulators, however, the concern is more long term and focused on an insurer’s claim-paying ability. Income statements are then more reflective of underwriting results, not stock investment choices and swings in market value. The results of investment choices are still looked at by regulators but with less focus on the insurer’s balance sheet only.

So, yes, two sets of books—and yes, it is both legal and appropriate.

This Student of the Industry article is part of a monthly column exclusively on iamagazine.com. Keep an eye on Thursday’s weekly News & Views e-newsletter in September for the next off-beat take on current trends in the insurance industry.

Paul Buse is operations and strategic advisor, Big I Advantage®.