Student of the Industry: Are You Watching the InsurTechs?

By: Paul Buse

In the first six months of 2020, InsurTech startups received $2.5 billion in funding, according to the Quarterly InsurTech Briefing by Willis Towers Watson and CB Insights. Of that U.S. investment, half is targeted at what they call “distribution” and the other half is business-to-business.

To put the distribution investment into an agent perspective, we will use a rough approximation of what those dollars would buy in agency-controlled premiums. That is, if you buy an agency, you generally control their book of business. So, if the distribution investment in the U.S. was targeted at independent agencies, how much control would you get?

To make this estimation, take the often-referenced “two-times revenues” agency acquisition multiple as a benchmark. With that as a proxy for what it costs to control the distribution of premiums, investors would be investing $1.25 billion per year at the current rate. That equates to $5 billion worldwide and $2.5 billion targeting the U.S., and half of that targeting distribution.

Applying the two-times revenues multiple, investors would acquire $625 million of agency revenues. Converting this back upstream into premiums with an average commission of 12.5%, the result would be $5 billion in premiums. In a year like 2020, investors would gain $5 billion in premiums.

But what does $5 billion in premiums mean? Well, it equates to just over half of the Strategic Insurance Agency Alliance’s (SIAA) self-reported premiums or five times the Iroquois Group‘s self-reported premiums. Insurers with around $5 billion in premium include The Cincinnati Insurance Companies, Hanover Insurance Group Property Casualty Companies and National General Companies. In terms of U.S. market share, if U.S. insurance premiums—property-casualty and life-health—is about $1 trillion, that’s one-half of 1% of U.S. market share acquired per year.

So, who are these guys that are taking up so much money?

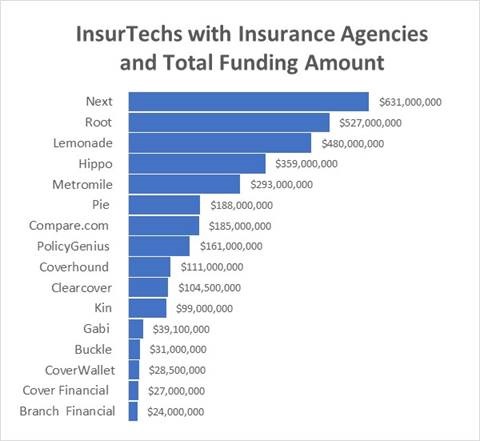

Below is a graph of InsurTechs that have received start-up funding and are focused on distribution—all have insurance agencies in their corporate structure. This is not all the InsurTechs focused on distribution, but those with published funding and agencies. Examples of those not included would be those financed more quietly like State Farm’s HiRoad or the insurance wholesaler Attune.

Source: Crunchbase. Funding data as of Sept. 24.

But what are these InsurTechs selling and which insurers are they selling policies for?

All of the above have p-c licenses while three have l-h licenses as well. In my review of all the webpages, I believe it’s fair to conclude all aspire to have licenses in all states.

Presently, nine have licenses in what appears to be all states—I used NY, OH, TX, CA and WY as indicators, since, in my experience, if an insurance intermediary is licensed in these states, generally, an insurance intermediary is licensed in all states.

Who are the InsurTechs selling for?

Below is a chart of the InsurTechs with a list of the insurers they have registered appointments with in at least one state. A student of the industry trick you should be aware of, by the way, is that you can look up any licensed insurance intermediary and see what insurer they can potentially place business for as the insurer’s agent.

I used a shorthand name for the insurance group A.M. Best Company designates as “Ultimate Parent Name” of the actual insurance company names listed in these appointments.

Source: I used online agency appointment lookup tools of the state insurance departments of CA, TX, OH or WY. Sampling indication only.

The asterisk indicates InsurTechs that are reported to have their own insurer in their structure. Those affiliated insurers are listed first along with the other insurer groups they are appointed with. With the exception of Hippo’s Spinnaker Insurance Company, none of the affiliated insurers are rated by A.M. Best.

Another student of the industry trick you should be aware of is looking up these insurer appointments. For the above, I used CA, TX, OH and WY but agency appointments can vary by state. Also, I did not use New York as it does not readily display entity agency appointments.

A word of caution: Many state insurance departments have laws or regulations against referencing the financial strength of insurers licensed to do business in their state. As agents, being aware of the financial strength ratings is very appropriate—but you should know your state laws and regulations with respect to referencing the ratings of insurers in a competitive sales or marketing situation.

Are you watching the InsurTechs? It’s a good place to spend some time as students of the industry. If you want a thorough review, I recommend signing up for the Willis Towers Watson and CB Insights quarterly InsurTech summary. The funding and rapid development of InsurTechs is a little like being an insurance Charles Darwin. For him, it would be watching natural evolution in years, not centuries. For us, it’s like watching insurance evolution in months, not decades.

Inspiration for this month’s cartoon goes to Joe Jackson and his 1979 album “I’m the Man.”

If you have an insight or topic you are interested in looking into, email me. Keep an eye on Thursday’s weekly News & Views e-newsletter in October for the next off-beat take on current trends in the insurance industry.

Paul Buse is operations and strategic advisor, Big I Advantage®