COVID-19 has the potential to drive price increases on lines of business that are impacted by this historic event, but if insurer finances also enter the picture it can be an entirely different story.

"The 1980s hard market was like a stringer of fish."

That's how Cloyce Anders, the former chairman of the Big “I," explained it. Speaking at a Big “I" Professional Liability Committee meeting, Anders relayed the fishing anecdote while discussing hard insurance markets. It is well known that rapid changes in premiums bring other changes, and changes can increase risks of agent errors & omissions.

But what does fishing have to do with hard markets?

Many of you may be aware of the '80s liability insurance crisis when America experienced the most dramatic increase in insurance prices. In fact, Time magazine's cover issue in March 1986 was "Sorry, America, Your Insurance Has Been Canceled."

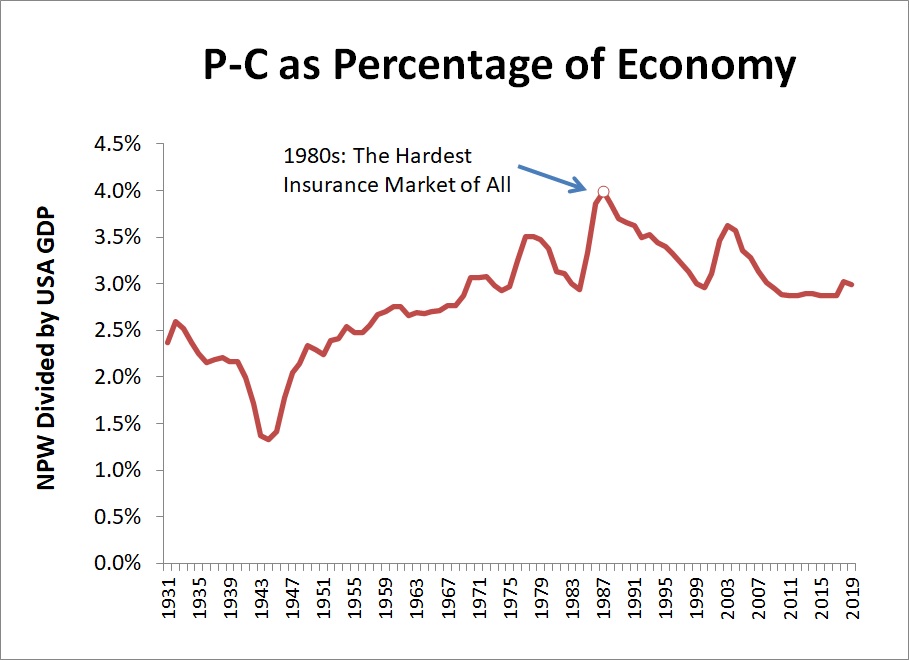

Below is the graphic evidence showing property-casualty industry premiums in relation to all spending in the economy. It illustrates the peak-year in the hard market of the '80s was in 1987, during which, if the average American spent $100 on everything, $4 of those dollars was spent on p-c insurance.

Let's look deeper at Anders' fishing stringer story. To understand, you need to know that in the '80s litigation and lawsuits were growing. The U.S. had generally prospered since World War II and it was during this time that the number of lawyers grew and that accelerated in the 1970s and 1980s. There were 18 lawyers per 10,000 residents in the USA in 1975, according to the American Bar Association. Ten years later, in 1985, that number had grown by 50% to 27 lawyers per 10,000 people. More lawyers correlated with more lawsuits—and that made insurers cautious about taking on liability insurance. That was the proximate cause of the hard market.

The cause, however, is not the point of Anders' fishing limit story. His point was that the cause was amplified by insurer finances. He explained that insurers in the '80s were like your average angler who realizes they are one fish away from the legal limit and therefore the angler gets very picky about the next fish they keep. Furthermore, it was like the legal fishing limit was reduced in the middle of the day!

What happened? The return on insurer investments fell dramatically.

The 1970s were known for more than bad hair and disco. While the 1970s were a time of very high interest rates, that changed in the 1980s. For perspective, consider today's 3%-4% mortgages were 12%-13% in the 80s. High-quality corporate bonds that were paying 13% to 14% today only paid 1% to 2%. Those high rates were ripe for change and they did, suddenly. In just two years between June 1984 to June 1986, bond yields dropped by 5 percentage points.

Insurers suddenly realized that investment income on the premiums they took in would earn them far less. Adding to that, the reinsurers that insurers depended upon to share risk saw the same thing.

Suddenly, what was a profitable line of business with combined operating ratios over 120% was no longer profitable and the supply of insurance risk-takers shrank overnight. Insurers' desire to take risk fell. When you add the support of reinsurers falling at the same time, the effect was amplified. As Anders relayed at the time, it was like someone lowered the legal limit from five fish to four fish. If you think about that Time cover, that explains a lot.

Recently, there has been much discussion about hardening insurance markets. I wrote about what is looking like a hard market in directors & officers insurance several weeks ago. What I hear is COVID-19 has the potential to drive price increases on lines that are impacted by this historic event. D&O may well be one of those.

As students of the industry, your perspective should be that hard markets caused by losses are one thing, but if insurer finances also enter the picture it can be an entirely different story.

This Student of the Industry article is part of a new monthly column exclusively on iamagazine.com. Keep an eye on Thursday's weekly News & Views e-newsletter in August for the next off-beat take on current trends in the insurance industry.

Paul Buse is operations and strategic advisor, Big I Advantage®.