Today’s agency owners have many options when considering potential perpetuation partners beyond just the highest possible valuation.

In the mid-1990s, there were only five acquirers of insurance agents and brokers with the capital and appetite to do mergers & acquisitions on a national scale. Now, only 25 years later, at least 40 buyers are competing for deals nationally.

Competition among these buyers is one of the primary drivers behind the current record-high valuations. While high valuations are great news for sellers, the increased buyer competition also creates another powerful seller benefit: agency owners have an unprecedented number of options for perpetuation partners.

In the not-too-distant past, a selling agency had few choices when selecting a perpetuation partner. And for the most part, they all looked pretty much the same. All were very large, had similarly rigid processes, and essentially offered indistinguishable benefits—capital, expanded market and program access, and a set operating structure.

Selling an insurance agency in 1995 felt a little like buying a car in the 1960s—choices were limited and customization almost non-existent. Back then the “options" conversation rarely extended beyond the manufacturer—GM, Ford, Chrysler or Volkswagen—the color, and the desired sound system—AM, AM/FM or, if you were a thrill-seeker, an 8-track tape system. There simply weren't a lot of customizations available, and you largely just purchased whatever the dealer had on the lot.

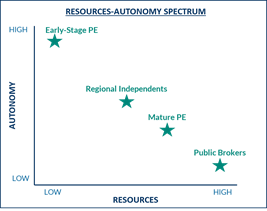

Not surprisingly, today's agency owners have many objectives when considering potential perpetuation partners beyond just the highest possible valuation. And when considering perpetuation partners, it's helpful to think about seller objectives across the autonomy versus resources spectrum.

Autonomy is important to many sellers who value their independence and fear a buyer will demand changes that undermine their culture and the overall success of their business.

Resources, or the tools and capabilities a buyer provides to sellers to help them to remain relevant in the middle-market, are highly attractive. These resources often take the form of programs, technology, training, leadership, recruiting and practice group expertise.

Resources, or the tools and capabilities a buyer provides to sellers to help them to remain relevant in the middle-market, are highly attractive. These resources often take the form of programs, technology, training, leadership, recruiting and practice group expertise.

Buyers who offer maximum autonomy post-close, such as early-stage private equity firms, tend to offer far less in terms of available resources. Buyers who offer limited autonomy post-close, such as more mature private equity and public brokers, tend to offer far more in terms of resources. Larger regional independent agents and brokers tend to occupy the middle ground.

Every buyer in the marketplace lives at a unique slot in this autonomy versus resources spectrum. This is great news, as it has never been easier for selling agents and brokers to find the right buyer to meet their objectives.

The downside is that the number of choices to navigate when considering a sale to a third-party buyer are overwhelming. No one has the time to research and vet every buyer in the marketplace. Agents and brokers considering a sale are wise to select an experienced M&A adviser who can help them better understand the current universe of buyers and how those buyers can best meet their needs and objectives, whether that's more resources, greater autonomy or somewhere in the middle.

Tom Doran is a partner at Reagan Consulting.

| King of The Hill Since the mid-1990s, Reagan has tracked share price appreciation of about 30 of its annual valuation clients. Dubbed the “Reagan Value Index" (RVI), it is modeled after the Dow Jones Industrial Average.

A comparison of the RVI against the S&P 500 and Nasdaq demonstrates that the independent agency channel is “king of the investment hill," says Kevin Stipe, president and partner of Reagan Consulting. “A dollar invested in the RVI in 1995 is worth nearly $14 today." That same dollar is worth $6.10 on the S&P 500 or $12.20 on Nasdaq, he notes.—TD |