With the current record high valuation levels—and if the Federal Reserve lowers interest rates—deal activity is about to accelerate, so buckle your seatbelt.

The number of announced insurance brokerage transactions has grabbed headlines over the past 10 years. In 2023, there were 555 announced transactions, which was a 44% decline from 2021's high watermark of 977 announced transactions and the lowest number of reported transactions since 2016. However, this statistic is just the tip of the mergers & acquisitions iceberg and does not tell the entire story—there is so much more going on beneath the surface.

The M&A market is still healthy and robust with more than 60 active acquirors. Interest rates have stabilized, buyers have reset their capital structures, and integration and technology investments have increased. Meanwhile, there are still over 35,000 independent insurance brokers navigating their path for growth.

Recently, I was speaking with the CEO of a private equity-backed insurance brokerage who had lost out on some high-quality, high-growth agency sales. “It feels like valuations are creeping back up. We keep losing on deals, and if there is one thing I have learned about private equity, they don't sit on the acquisition sidelines—they are either buyers or sellers," he remarked. “Seems like we need to go back and sharpen our pencils on valuations."

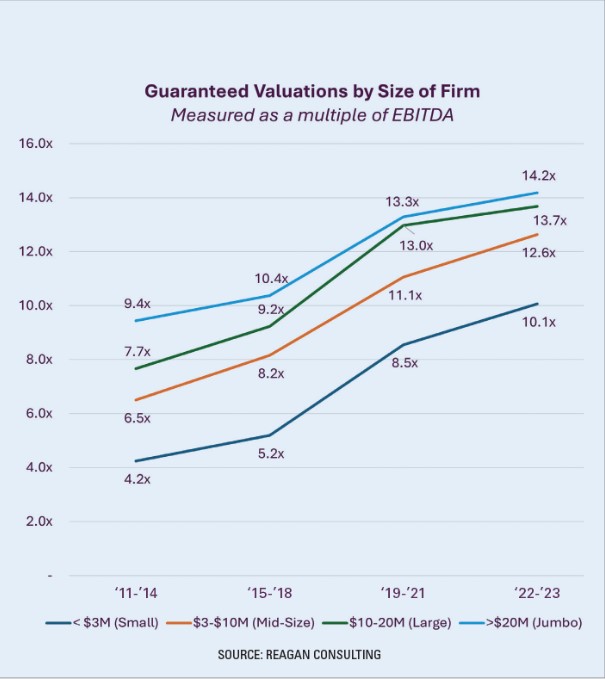

This comment solidifies the notion that valuations are on the rise. Furthermore, the chart shows that for every revenue category of firms, guaranteed valuations have consistently increased over the past 10 years.

With the current record high valuation levels—and if the Federal Reserve lowers interest rates—deal activity is about to accelerate, so buckle your seatbelt. With the average age of current agency owners being in the late 50s, many of those individuals are beginning to think about retirement, financial diversification or both.

Private ownership only pays off if you are willing to bet on yourself and sustain top-quartile performance. According to the Rule of 72, if an agency grows at 15% per year for five years, it will double in size. However, as agency owners can appreciate, this top quartile performance takes significant work and financial investment.

In 2023, there were 40 privately held brokers in the Top 100, which is down from 62 in 2017. Although internal perpetuation is not a get-rich-quick scheme, it is a long-term, proven path to wealth creation. However, if a thoughtful perpetuation plan has not been put in place, the allure of doubling the firm's internal valuation overnight, which often happens in a third-party sale, is enticing.

In a third-party sale, profitability margins are increased through standardizing producer compensation, eliminating non-recurring personal expenses, and benefiting from a buyer's synergies, such as HR, payroll and IT. Many of today's most active acquirers were owners and operators of independent brokerages who decided it would be more fun and less risky to work alongside like-minded owners as opposed to staying independent.

In a rapidly consolidating industry, it feels like the mindset of the independent broker is shifting from selling out to selling in. Additionally, most acquirers are not paying all cash and want sellers to take equity as part of their sale proceeds.

As a trusted adviser to agency principals and evaluator of their perpetuation plans, it is not easy to navigate the current M&A market. There is a lot of noise and misinformation in the marketplace, but focusing on the fundamentals to lead a quality, organic-growth-first organization will preserve your ability to choose the perpetuation path that is best for you, your colleagues and your customers.

Harrison Brooks is a partner at Reagan Consulting.