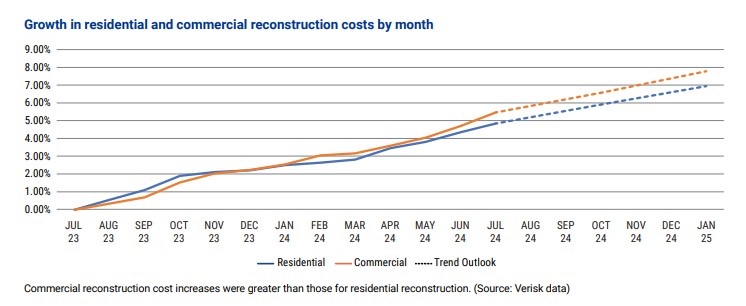

Both residential and commercial property saw total reconstruction costs increase from July 2023 to July 2024.

Total reconstruction costs in the U.S. rose by 5.2% from July 2023 to July 2024, according to “Verisk's 360Value Quarterly Reconstruction Analysis for Q3," a significant increase over the 4% cost growth from July 2022 to July 2023.

Total residential reconstruction costs increased 4.9% between July 2023 to July 2024 when every state saw an increase. New Hampshire had the highest increase at 9.6%, followed by Colorado at 9.1% and Nebraska at 6.4%.

Commercial property saw total reconstruction costs increase by 5.5% from July 2023 to July 2024, increasing by at least 3.4% in every state. Again, New Hampshire had the highest increase at 12.4%, followed by Colorado at 11.6% and Massachusetts at 8.9%.

For the first time in several years, the cost of materials rose more than labor costs: 4.4% for materials compared to 4.31% for labor. However, the rise in material costs was not evenly distributed—growth from January 2024 to July 2024 has already surpassed the total growth for 2023, increasing 1.8% compared to 2023's total of 1.2%. The report notes that if the acceleration continues, the cost of materials could increase by 3% in 2024, more than double the increase in 2023.

“The market expectations for reconstruction costs increased 2% for residential and 2.2% for commercial from July 2024 to January 2025," the report said. “The most significant indicator was concrete, increasing by 5.6%."

Concrete composite saw the largest cost increase of all materials, up 13.9% year-over-year. Lumber prices are also on the rise again, with an increase of 2.1% from July 2023 to July 2024, after a decrease of 6.4% from April 2023 to April 2024.

Meanwhile, combined hourly retail labor costs increased by 4.3% from July 2023 to July 2024, a significant drop from its 6.2% increase from January 2023 to January 2024. However, the second quarter of 2024 saw a 1.4% increase compared to the first quarter's 1.1% increase.

Concrete masonry labor costs rose 20.4%, increasing five times more than the next-highest group, drywall finishers and installers, whose rates increased 4.0%.

While average roof replacement costs increased 0.2% in the overall U.S., Texas saw an increase of 1%. In particular, Verisk's study noted that the cost of roof replacements in the Dallas/Fort Worth and Sherman, Texas, areas increased significantly due to severe wind and hail storms in May. The cost to remove and replace a 23-square laminated shingle roof increased by 7.5% in Dallas/Fort Worth and 9.7% in Sherman, primarily driven by labor costs.

AnneMarie McPherson Spears is IA news editor.