Congress Passes Tax Reform

By: Jennifer Webb

Last Friday, tax conferees in the U.S. House of Representatives and U.S. Senate released their final version of tax reform legislation. After very minor changes were made to conform to Senate rules, the Senate passed the legislation early Wednesday morning. The House followed suit later the same day. President Trump is expected to sign the legislation into law in the coming days.

Members can log in to the Big “I” government affairs tax webpage to view a two-page summary of the major provisions of the bill.

The centerpiece of the legislation is tax reform for businesses, particularly C corporations, which will see their statutory tax rate lowered from a top rate of 35% to 21% starting next month.

The legislation also includes changes to the way pass-through businesses—such as S corps, partnerships and sole proprietorships—are taxed. While income from pass-through businesses will continue to be taxed at the relevant individual rates, owners and shareholders of smaller insurance agencies organized as pass-throughs will also be able to deduct 20% of “qualified business income.”

Under the legislation, an owner or shareholder of a “specified service businesses”—which includes most, if not all, activities related to selling and servicing insurance—may deduct 20% of their “qualified business income” if their annual taxable income does not exceed $315,000 for joint filers and $157,500 for single filers in 2018 and then indexed for inflation going forward.

Where filers have annual taxable income between $315,000 and $415,000 (joint), and $157,500 and $207,500 (single), the benefits of the 20% deduction are phased out. Trusts that are owners or shareholders in a pass-through business may also use the deduction.

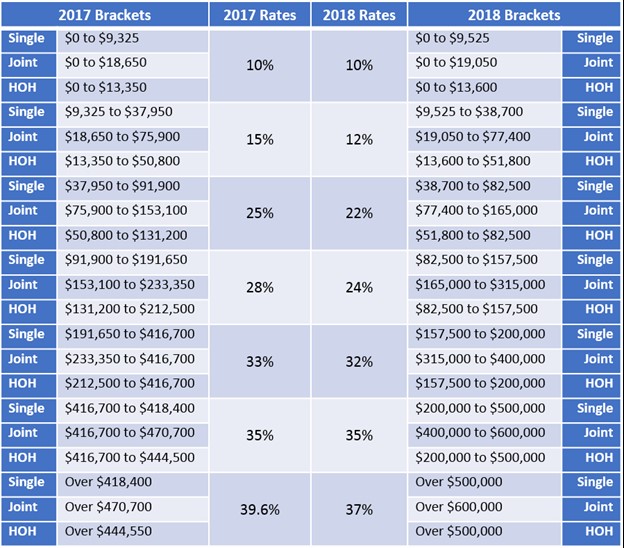

The legislation also amends individual tax rates, nearly doubles the standard deduction, and modifies several popular tax breaks and deductions:

While the tax cuts for corporations are permanent, the changes to taxation for individuals—including the 20% pass through deduction—are scheduled to expire on Dec. 31, 2025.

Finally, on an issue important to the property-casualty market, a coalition of U.S.-based insurers succeeded in tightening tax laws related to non-U.S. insurers and reinsurers that utilize affiliated reinsurance.

As the legislation is enacted into law, keep an eye on the Big “I” government affairs tax webpage for more in-depth analysis tailored to Big “I” members.

Jennifer Webb is Big “I” federal government affairs counsel.