While the composite rates for both commercial and personal lines decreased overall in second quarter 2021, all segments experienced rate increases.

The second quarter 2021 composite rate for commercial lines decreased to 5.9%, down from 7% in the first quarter of 2021, according to MarketScout. The personal lines composite rate is also down slightly to 4.8% from a 5.6% rate assessment at first quarter.

While the overall composite rate index moderated, all commercial segments experienced rate increases. Professional line rates positively impacted the overall commercial composite rate with an increase of just 4.3% in the second quarter, compared to 11.3% in the first quarter.

However, large rate increases were seen in the umbrella and excess line of business, which saw an increase of 11.6%. Directors & officers liability rates increased 11%, commercial property increased 9.6%, auto increased 9% and business interruption increased 7%.

“This quarter there was a slight trend towards rate moderation, but this could be an aberration," says Richard Kerr, CEO of MarketScout. “Let's see how the rest of the year plays out before we make any predictions about market rates moderating. We are now entering hurricane season and this fall we will be in wildfire season. Property rates continue to rise and could get even higher."

Below is a table containing market data of second quarter commercial rate increases.

Commercial property

| Up 9.6%

|

Business interruption

| Up 7% |

Business owners policy | Up 4% |

Inland marine | Up 4.2% |

General liability | Up 6.3% |

Umbrella and excess | Up 11.6% |

Commercial auto | Up 9% |

Workers compensation | Up 1%

|

Professional liability | Up 4.3% |

D&O Liability | Up 11% |

Employment practices liability | Up 7% |

Fiduciary | Up 2% |

Crime | Up 3% |

Surety | Up 1.3%

|

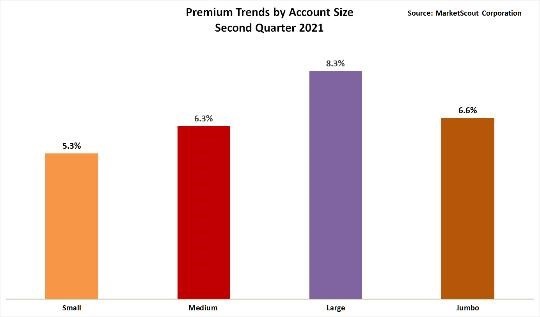

Additionally, small commercial insurance buyers paying $25,000 or less in premium were paying a slightly lower rate at 5.3% at second quarter, down from 6.3% in the first quarter.

On the personal lines side, MarketScout reported that all personal lines coverages were less expensive in the second quarter in comparison to the first quarter.

Over the next five or six months, “rates could change quickly," Kerr says. “An increasing number of homeowners are using non-admitted insurers. When non-admitted insurers are hit with significant losses, they can adjust rates very quickly."

Below is a table containing market data of second quarter personal line rate increases.

Homeowners under $1,000,000 value

| Up 4.6% |

Homeowners over $1,000,000 value | Up 5.6% |

Automobile

| Up 4% |

Personal Articles | Up 4%

|

MarketScout is a national MGA and wholesale broker specializing in assisting agents in placing high net worth personal lines business.