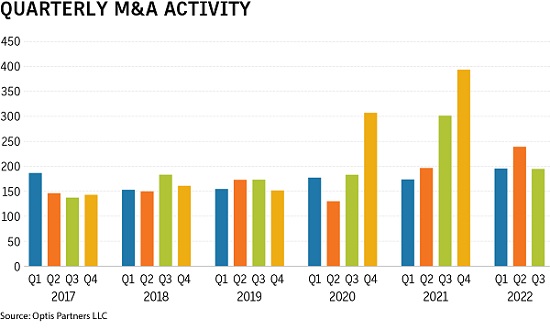

Even as the fall reflected a return to "normal" after a spike in mergers & acquisitions last year, the third quarter of 2022 was the second-busiest quarter for M&A activity ever.

The number of mergers & acquisitions involving insurance agents and brokers reached 555 in the first nine months of 2022, which is 14% down compared with the record level of deals in the same period last year, according to a report by Chicago-based mergers & acquisitions advisory company Optis Partners LLC.

There were 1,034 announced insurance agency mergers and acquisitions in 2021, up 30% from the 795 reported in 2020, which was an all-time record. The broker-led M&A deal flurry was set to continue in 2022 after the first half of 2022 reflected a 16% increase from the same period in 2021.

However, the fall reflected a return to “normal" after an increase in M&As last year, when many owners sold their agencies fearing a potential increase in capital gains tax, according to the report.

“This return to a 'normal' number of deals is to be expected considering the surge in deals last year along with the fact that a lot of the agency owners contemplating whether or not to sell pulled the trigger on it in the last few years," said Dan Menzer, partner at Optis. “The inventory has shrunk."

Nonetheless, the third quarter of 2022 was the second-busiest quarter for M&A activity ever, according to the report. Deal flow remained very healthy and notwithstanding the 2021 spike, the third quarter of 2022 is still 15% higher than the four-year average from 2017-2020. Looking ahead, 2022 is expected to close out with a return to a normal environment for deals.

While factors such as rising interest rates and inflation may limit some acquisitions, it has not affected the prices being paid to acquire companies, the report states.

“The increase in the cost of capital should work to reduce values, yet the ever-expanding number of buyers appears to be propping them up," said Tim Cunningham, managing partner at Optis.

There were significant deals announced in the third quarter including: IMA Financial Group Inc.'s purchase of York International Agency LLC; Truist Insurance Holdings Inc.'s acquisition of BenefitMall Inc.; and Arthur J. Gallagher & Co.'s purchase of M&T Insurance Agency Inc., the report said.

Companies that made more than 15 acquisitions during 2022 include Acrisure with 80 transactions in the first three quarters of 2022, followed by PCF Insurance Services with 56 deals. Hub International Ltd was third with 50 deals; High Street Insurance Partners Inc. was fourth with 30; and Inszone Insurance Services Inc. was fifth with 23.

Olivia Overman is IA content editor.