Restaurants continue to experience significant challenges from increasing payroll costs, inflation and claims, according to a report from NEXT Insurance.

While restaurants have seen a substantial recovery in revenues since the pandemic, they continue to experience significant challenges from increasing payroll costs, inflation and insurance claims, according to a report from NEXT Insurance, a California-based insurance technology company.

The report, which highlights data from over 30,000 small business restaurant owners across the U.S., analyzes revenue and payroll trends as well as the most common and severe insurance claims in select states.

While restaurant revenues have increased on average 6% annually since 2021, payroll costs have risen by an average of 10.9% per year over the same period. In 2021, payroll costs made up 23% of revenue and that percentage is expected to increase to more than 26% in 2024. Restaurants in California and Colorado are facing the highest payroll costs, the report said.

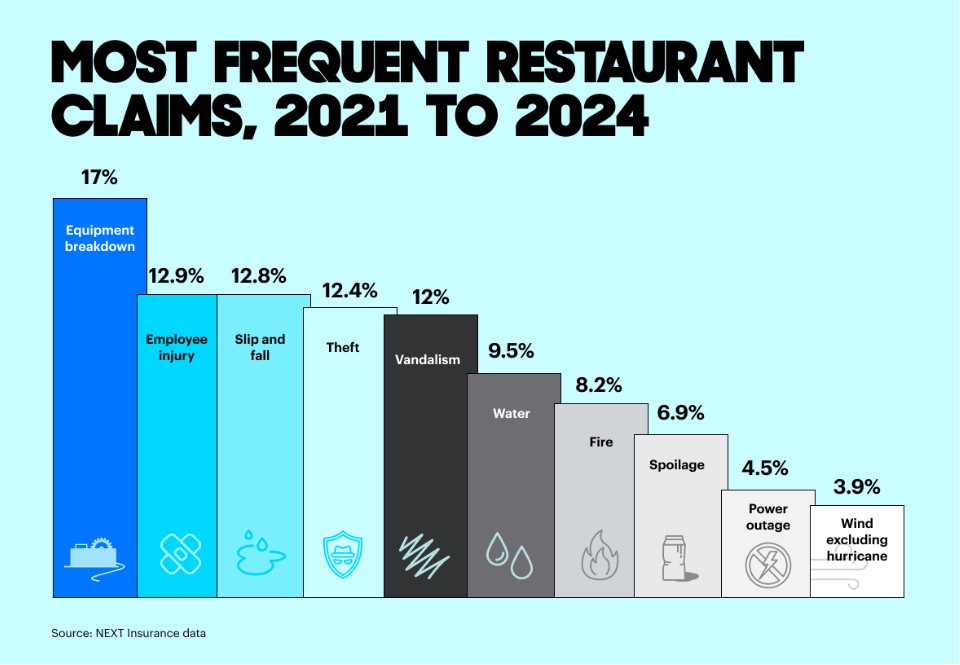

The top five most common insurance claims for restaurants from January 2021 to July 2024 include equipment breakdown, employee injury, customer slip and fall, theft, and vandalism, the report said. Other common claims include water damage, fire, food spoilage, power outage and wind (excluding hurricanes).

Further, the data identifies seasonal trends for property-related claims, with hurricane claims peaking in September to November; water damage claims most frequently seen from December to February; hail, tornado and wind (excluding hurricanes) claims most common from March to May; and power outages and lightning claims most frequent from June to August.

Though these trends are seasonal, many restaurant owners still find themselves unprepared year after year. Forty-eight percent of respondents reported winter weather-related damage, with over half admitting to not feeling adequately insured.

The report also offers tips for seasonal claims for restaurant owners, such as inspecting their roof and repairing any weak spots before winter; backing up restaurant data so they don't lose anything important in a storm; reviewing insurance coverage to identify coverage gaps and making adjustments as necessary to avoid being underinsured; and considering commercial property insurance for financial protection.

The most expensive claims experienced by restaurants include fire, customer slip and fall, assault and battery, and water damage. These claims can exceed $100,000, the report said.

“By analyzing a four-year snapshot of our restaurant data, we're able to uncover trends that not only aid in risk assessment but also empower small businesses to plan for growth and future success," said Effi Fuks Leichtag, chief product officer at NEXT.

By knowing the biggest threats to a restaurant—seasonally and geographically—a restaurant owner can better navigate these risks and create a more resilient business, the report said.

“Running any small business involves risks," says Chris Rhodes, chief insurance officer at NEXT. “That's why it's so important for small business restaurant owners to understand the most common threats and their associated costs."

Olivia Overman is IA content editor.