Earn-Out Evolution: How Have Sellers Performed Post-Closing?

By: Mark Crites

Merger and acquisition activity captures many of the headlines in the insurance brokerage industry and, given the transaction volume we have witnessed over the last decade, rightfully so.

Consolidation also continues to be a top trend because it has a profound impact on all facets of the distribution system. Consolidation, however, is most often discussed in the context of the initial transaction and rarely on what follows.

What about life after the deal for buyers and sellers? How do sellers perform during their earn-outs after closing? Does the earn-out structure matter? In a recent survey of 20 of the industry’s most active acquirers, Reagan Consulting sought to answer these questions. The survey reviewed the buyers’ completed deal activity from 2021 to 2023.

First, what is an earn-out? An earn-out is a performance-based payment available to a seller post-closing. It is a feature in the majority of transactions in the industry. Earn-outs are great incentives for sellers to continue to perform post-closing but also a tool for buyers to keep sellers engaged.

However, as buyer demand and valuations have accelerated, earn-out structures have evolved. Today, earn-outs typically last on average for three to four years post-closing and can be based on either revenue or EBITDA (earnings before interest, taxes, depreciation and amortization). Sellers will not typically receive any earn-out proceeds unless they achieve a compound annual growth rate (CAGR) equal to or greater than 5% during the earn-out period. Earn-out payments are generally maximized at a 20% CAGR.

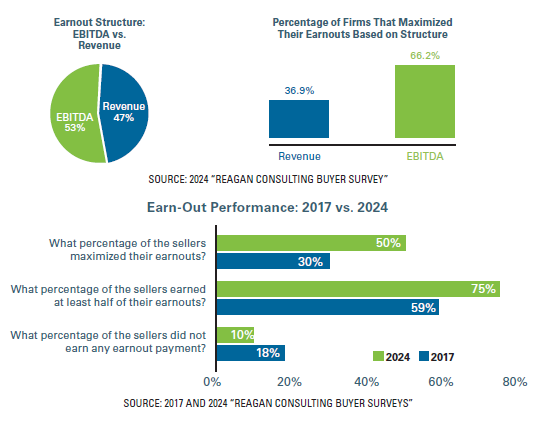

While there are transactions that have different thresholds for growth, a 5%-20% CAGR range is common, which is an increase from a 3%-15% range reported in a 2017 Reagan survey when more transactions had EBITDA-based earnouts.

The 2024 survey found that sellers with EBITDA-based earnouts maximized their total earn-out almost two-thirds of the time versus just over one-third for revenue-based earn-outs.

While EBITDA deals still represent a majority of the completed transactions, it is only a slight majority, as revenue-based earn-outs have become much more popular. This shift has been intentional. Buyers are demanding growth, acknowledging that they can manage profitability post-closing. Also, revenue is easy to track and generally allows for faster integration.

What about the size of an earn-out? With higher growth requirements, are sellers receiving a bigger payout if achieved? Yes. Like closing valuations, earn-out multiples have steadily grown since 2017. The average earn-out multiple being paid is 3.5x–4.5x EBITDA today compared to 2.5x–3.5x in 2017. Earn-out opportunities have kept pace with the closing multiples and still represent approximately 25%-35% of the overall valuation.

Even with longer earn-out periods and higher growth thresholds, sellers have been able to achieve better results. Half of sellers maximized their earn-outs during the last three years, a 67% increase compared to the 2017 survey. When comparing the 2017 and 2024 surveys, it is important to note that sellers have performed better during the last three years than in the three years leading up to 2017. Here are three reasons why:

1) The hard market. The industry is in a rising rate environment, which has propelled growth, especially over the last three years.

2) Buyers elevating seller performance. Integration was the theme of the industry in 2023 with several larger firms improving team structures and internal processes to unlock growth opportunities. This shift has allowed tools and resources to trickle down more effectively to recently acquired firms.

3) Expenses impacted by the pandemic. The pandemic shifted how the world thinks about digital communication and virtual work. Since 2020, overall occupancy and travel and entertainment expenses have consistently been lower. Sellers took advantage of this.

In a high-valuation environment, attractive earn-out opportunities can be a powerful way for buyers to differentiate themselves from others.

Sellers that believe in their ability to grow post-closing, especially with a buyer’s resources, should view the earn-out opportunity favorably, even with high growth requirements.

Mark Crites is a partner at Reagan Consulting.