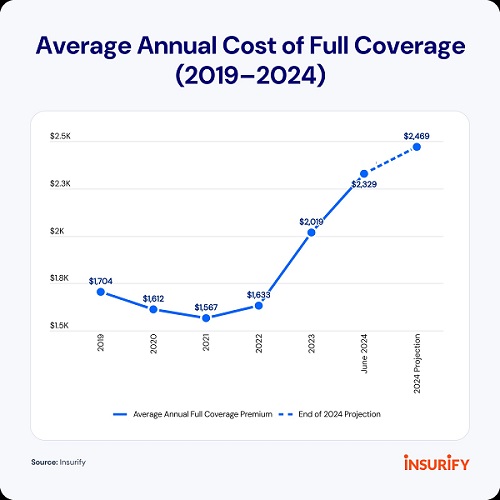

Underwriting losses of $17 billion last year drove 2024’s first half-increases, according to data analysis from Insurify, which predicts rates will increase a total of 22% by the end of the year.

Personal auto insurance rates rose 15% in the first half of 2024, according to data analysis from Insurify. The average annual premium now costs $2,329. By the end of the year, Insurify predicts that rates will have increased a total of 22%.

Maryland currently has the highest personal auto rates in the U.S., with an average of $3,400 annually. New Hampshire has the lowest, at $1,000 annually. However, California, Missouri and Minnesota are predicted to see auto insurance costs increase by more than 50% in 2024.

2024's rate increases continue the trend set in 2023, which saw premiums rise by 24% after insurers experienced record underwriting losses of $33.1 billion in 2022. While underwriting losses decreased to $17 billion in 2023, the hit was still enough to drive 2024's first-half increases.

One factor contributing to losses is vehicle maintenance repair costs—which have increased by nearly 38% over the past five years, according to data from the U.S. Bureau of Labor Statistics. While safety technologies can help drivers avoid crashes and the related premium increases, they're also expensive to repair. Advanced driver assistance systems (ADAS) can add up to 37.6% to the total repair cost after an accident, according to AAA data, and minor damages to front radar and distance sensors can add up to $1,540.

These costs are compounded by the increasing usage of expensive-to-repair electric vehicles, auto mechanic backlogs, and vehicles getting older as Americans hold onto their cars for longer. Average vehicle ages reached a record 12.6 years in 2024, according to S&P Global Mobility.

Increasingly severe and frequent weather events are also driving rate hikes. For instance, Minnesota experienced $1.8 billion in damages following a series of hail storms in August 2023, contributing to a 55% increase in rates. Hail-related auto claims represented 11.8% of all comprehensive claims in 2023, up from 9% in 2020, according to CCC Intelligent Solutions.

Hurricanes bring a surge of auto losses to coastal areas. For instance, during Hurricane Ian's peak days, Sept. 25-30, 2022, nearly 52% of Georgia, Florida, and South Carolina vehicle claims were total losses, according to CCC Intelligent Solutions. 2024 is predicted to be an extremely active hurricane season.

“I think climate risk will likely start to play a role in new areas. As we experience tornadoes, hail, and flooding in places where they weren't necessarily a major threat before, the increased frequency and severity of these events will need to be considered in pricing," said Betsy Stella, vice president of carrier management and operations at Insurify.

On the state level, legislative changes in states like Maryland—where drivers pay 46% more than the U.S. average and rates are projected to increase by 41%—and South Carolina—where drivers pay 43% more than the rest of the country with a 38% projected rise for 2024—have increased insurers' financial responsibility and led to higher premiums, Insurify said. California is catching up from the rate freezes during the coronavirus pandemic, leading to some insurers requesting double-digit hikes and others exiting the state entirely.

Additionally, car thefts have also driven up premiums. Missouri, which is predicted to see a 55% hike in 2024, and California, with a 54% predicted increase, are among the 10 states with the highest auto theft per capita, according to the National Insurance Crime Bureau.

It may be hard to believe now, but auto rates won't continue to rise forever. “Insurers implemented higher rate increases to account for changes in the frequency and severity of auto losses," Stella said. The COVID-19 pandemic and the following inflation, especially in the price of vehicle maintenance and repairs, along with changes in driving behaviors, led to new loss trends that increased the difficulty of rate setting."

“Some insurers have started making downward adjustments in areas where they've found opportunities to operate profitably while charging lower rates," she said. “Generally, consumers will continue to see rates rise with inflation, or in areas where traffic accidents are increasing, but in some states, they could see premiums decrease a little again."

AnneMarie McPherson Spears is IA news editor.