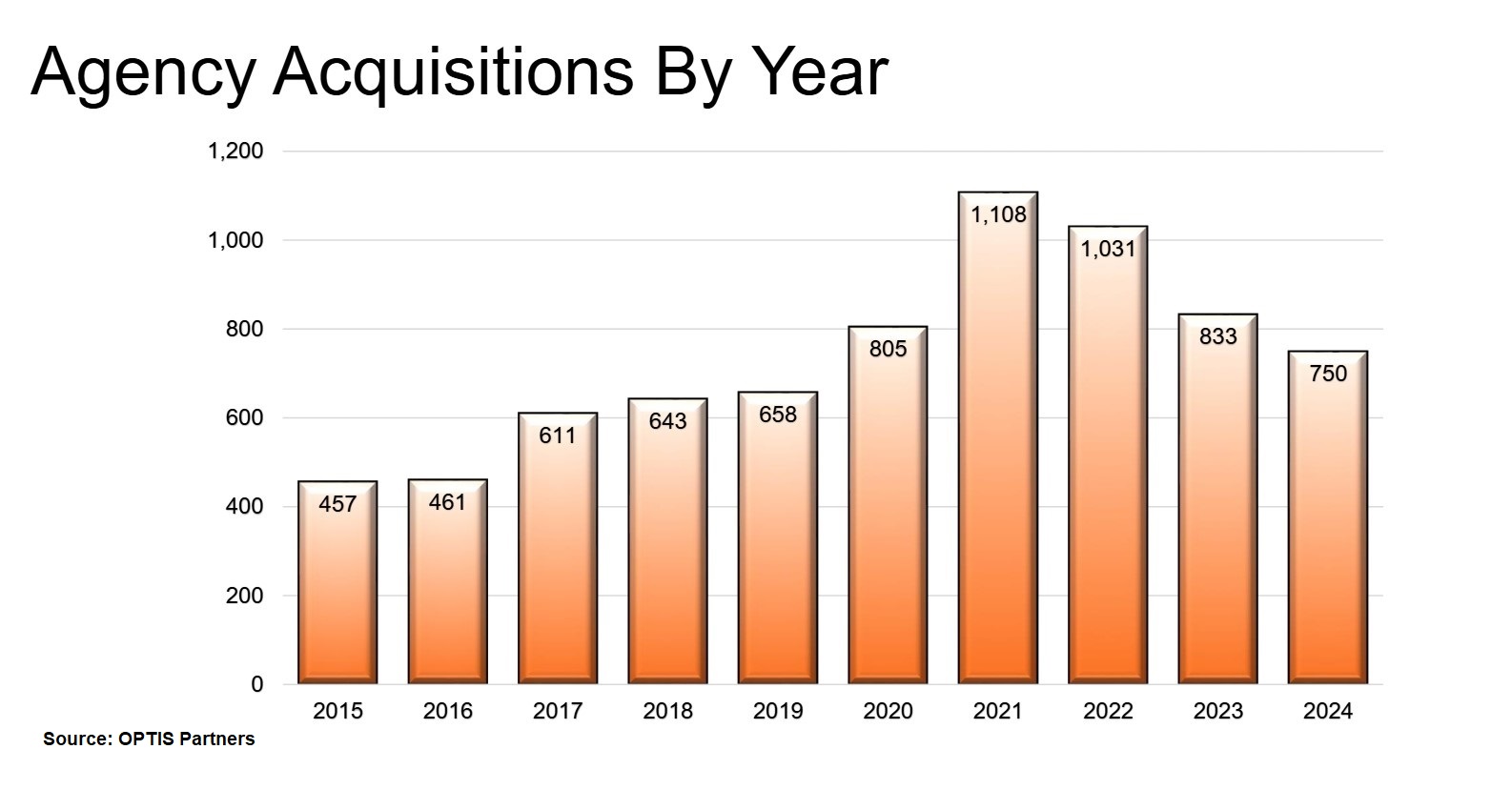

While 2024 saw decreased mergers and acquisition activity from the previous four years, activity was still higher than in pre-pandemic years.

There were 750 insurance agency and brokerage mergers and acquisitions in 2024, down 10% from the 833 reported in 2023, according to a report from OPTIS Partners, an investment banking and financial consulting firm specializing in the insurance industry.

Yet, while 2024 saw decreased M&A activity from the previous four years, activity was still higher than in pre-pandemic years.

“The M&A market is in a fairly steady state regarding both the number of transactions in the year and the pace of them throughout the year," said Tim Cunningham, managing partner of OPTIS Partners. “This is the second consecutive year in which there was no mad dash to closing a large number of deals at year-end."

2024 saw decreases in acquisitions from the most dominant buyers. Over the past 10 years, eight firms accounted for 42% of the deal. However, in 2024, several of those firms clocked in at well below their 10-year average, including Acrisure, AssuredPartners and PCF Insurance. Only BroadStreet Partners had a material increase in the number of deals with 90, followed by Hub with 61 and Inszone Insurance Services with 48 deals.

Private equity (PE) and hybrid buyers accounted for 72% of the 2024 transactions, continuing to hold the lion's share of deals with 69%-75% of all transactions in each of the past seven years.

Three "giant deals" occurred in 2024. Aon PLC purchased NFP for $13 billion in April, Marsh & McLennan purchased McGriff Insurance Services for $7.75 in November, and Gallagher announced its acquisition of AssuredPartners in December to the tune of $13.45 billion—the largest sale of a U.S. insurance broker in the history of the insurance industry, once the transaction closes in the first quarter of 2025.

“We think there could be some more large deals in the next 12-24 months, though likely not of the magnitude of these three. Nonetheless, the chase for scale continues," Cunningham said.

Agency M&A saw a peak of 1,108 deals in 2021.

AnneMarie McPherson Spears is IA news editor.