M&A Market Contemplates Potential Tax Changes

By: Brian Deitz

The mergers & acquisitions (M&A) market for agents and brokers is driven by many macroeconomic forces. Interest rates, property & casualty insurance pricing, and public broker valuations all play their part in influencing deal activity. But we may soon witness a more pragmatic impact—a change to capital gains tax rates.

Kamala Harris, the Democratic Party presidential candidate, leads in most polls. At the time of writing, a compilation of respected polls show Harris leading by an average of 1.5 points over Republican candidate Donald Trump. If Harris emerges victorious in November, her tax plans include a new all-in suggested capital gains tax rate of 33%, which is a huge hike compared to the current all-in rate of 23.8%.

Harris’ tax plan pairs a 28% capital gains rate—currently at only 20%—with a 5% net investment income tax. The net investment income tax, currently at 3.8%, was implemented as a part of the Affordable Care Act and applies to capital gains, interest income, dividends and other income streams.

The potential tax increase means that sellers could pay 9.2% more in capital gains taxes on the sale of their agency. In other words, a seller who completes a $3 million sale of agency equity would pay an extra $276,000 in federal taxes if Harris’ plan is passed.

Of course, the proposed tax changes would need to become law after Harris is elected and there is no certainty that Congress will pass these changes. However, M&A volumes can be influenced by the mere threat of tax changes and we have seen capital gains changes—threatened or actual—accelerate M&A activity. Taxes alone don’t tend to make sellers out of agencies that are committed to long-term internal perpetuation but they can make those that would have been sellers over the short-term become sellers now.

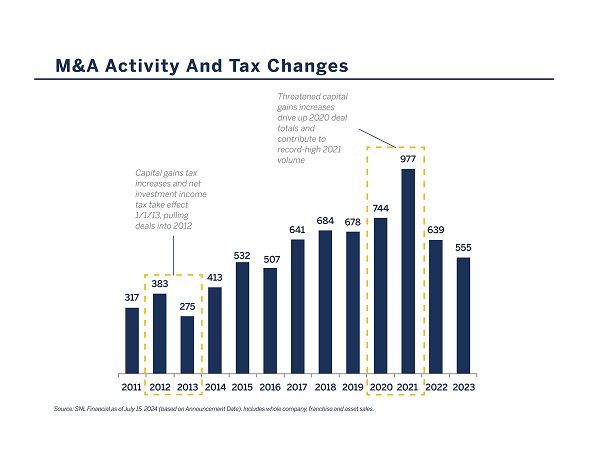

Historically, deal activity in our industry has jumped as tax changes loomed. In 2012, the capital gains rate was scheduled to move from 15% to 20% as of Jan. 1, 2013, and the net investment income tax went into effect the same day. Sellers were looking at a capital gains increase from 15% for deals done in 2012 to 23.8% for deals done in 2013. As a result, many sellers accelerated their transactions into 2012 and deal activity increased by 21% in 2012 to 383 deals, a new annual record at the time. Consequently, the 2013 deal count fell 28% to 275 because many of the would-be 2013 sellers had already closed their deals.

We saw a similar phenomenon in 2020 based on President Joe Biden’s proposal to increase capital gains rates. While this change never materialized, the specter of it set into motion many transactions in late 2020 and even into 2021. While these threatened tax increases weren’t the only contributor, they were part of the fuel for the industry’s most active deal stretch ever.

As we march toward the election and contemplate future deal activity, the tax picture will likely be a significant influencer. Of course, the political winds could shift and suggested higher capital gains tax rates could fade, leaving little impact on the M&A market. Alternatively, the higher rates could become more of a political certainty and drive sellers who were considering a sale within the next three years into the market immediately.

Brian Deitz is a partner at Reagan Consulting.