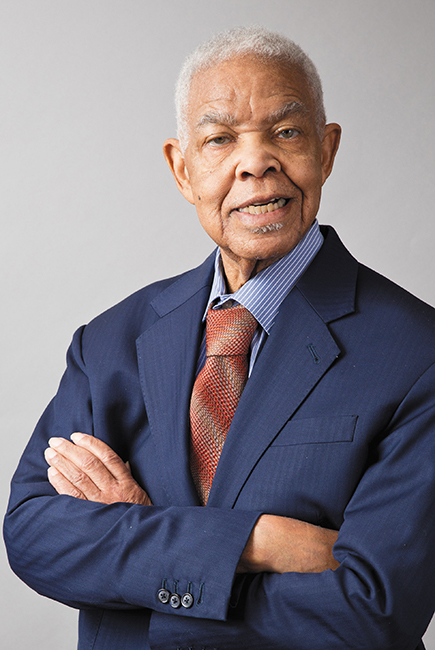

Fred Davis

Fred Davis

Owner

Fred L. Davis Insurance Agency

Memphis, TennesseeWhen Fred Davis got out of the Army in the late 1950s, he and his wife had two kids and no car.

To support his family, Davis started selling insurance door to door in the Orange Mound neighborhood of Memphis, Tennessee. He worked the territory for five years, gaining an intimate knowledge of the neighborhood.

“I knew everyone in every house on every street, and they all knew me,” recalls Davis, the first African-American member of the Big “I.” “But professional opportunities for me, a college graduate in business, were very limited. Back then, Black people couldn't get those professional jobs. They wouldn't hire you.”

Davis couldn’t even take the licensing exam unless he got a licensed agent to sponsor him. “But hell, there weren't any Black licensed insurance agents,” he recalls.

GREATEST CHALLENGES?

Russell Sugarman and A.W. Willis, two prominent Black attorneys in Memphis, had some real estate they were about to close on, and they wanted me to write the insurance. They asked a white agent to sponsor me. I passed the insurance licensing test, got licensed, and then wrote the insurance on the properties.

But I had to run it through the white insurance agent, and the policy had to go to the white company. No white company would sign a contract with a Black agent.

GOING INDEPENDENT?

I was friends with John and Jim Collier, who owned Collier Insurance. We met at a "Great Books" discussion group at a church on Union Avenue. We often discussed the challenges I faced being Black in the insurance industry and having to get a white agent to sign off on everything I did.

One day, Jim said to me, "Fred, I'm going to get you licensed as an independent." They took me down to a carrier’s regional office in Memphis, gave the manager the paperwork, and asked him to give me a contract. Jim said to the manager, "Sign it." He did. The Colliers had great influence.

Even to this day, the only way to learn this business is to be in the business. There is no college you can go to and learn how to run an insurance agency. The carrier’s office manager asked, "So who's going to train him?" Collier said, "We are."

They spent years, from that first day, working with me and training me and teaching me until I could fly on my own. They taught me the rudiments of the insurance business, from the simplest procedures to the complexities of the business.

When I opened Fred L. Davis Insurance Agency in 1967, I was the first Black independent insurance broker in six states: Tennessee, Arkansas, Mississippi, Kentucky, Alabama and Missouri. We've been located in the Orange Mound neighborhood since 1968. I’ve been used as an example to other Black people in the insurance business, and I'm pleased with that.

WHAT MAKES YOUR AGENCY UNIQUE?

Before I was established, you couldn't insure your home, car or property with a Black person. Now, I have two women, both licensed professionals, who work for me. One has been with me 27 years, and the other has been with me 30 years.

My staff drives up in nice cars, nicely dressed, and young people in Orange Mound see that it's possible for people to be prosperous, working in a Black business. There are not many examples of that in this neighborhood.

YOUR BACKGROUND?

I graduated from Manassas High School in 1953 and went to Tennessee State University in Nashville, where I met my wife, Ella. Ella graduated a year before me, and back in Memphis she worked for Universal Life Insurance Company. We married in April 1957, the same year I graduated from college. Ella is the first African-American woman to earn an MBA from the University of Memphis.

YOUR PART IN THE CIVIL RIGHTS MOVEMENT?

In 1968, I ran for and was elected to the Memphis City Council. I was chairman of the Public Works Committee during the sanitation workers strike of 1968. For weeks before the assassination of Dr. Martin Luther King, I had been putting before the Council different proposals to settle the strike and recognize the strikers' union, but none of them had been accepted. I had told the Council in my forecasts the kinds of things that could happen if that strike kept going on. I didn't foresee Dr. King being killed, but I did foresee an explosion in the Black community.

For the Mountaintop Speech, Rev. James Netters, another member of the Memphis City Council, and I were taken into Mason Temple through the back door and were seated on the edge of the stage, next to the steps. It was a great place to sit, not only for the view, but also because if we had been in the audience with the sanitation workers, they would have skinned us alive.

Dr. King was not originally scheduled to speak that night—it was supposed to be Rev. Ralph Abernathy. But the crowd kept calling for Dr. King to speak. While we were waiting for him to arrive, Stokely Carmichael came in, went straight to stage and gave a rousing Black Power Salute. Then he and his entourage went out the side door again. We felt that his folks must have been in the car with the motor running. Dr. King arrived shortly afterwards.

POSITIONS AND HONORS?

In 1972, I became the first African American to chair the Memphis City Council. Over the years, I’ve been president of the Orange Mound Civic Club, president of the Liberty Bowl, founding director and past president of the Mid-South Minority Business Council, recipient of the Humanitarian Award of the National Conference of Christians and Jews, inducted into the Society of Entrepreneurs, past president of the University of Memphis Society, trustee of the Community Foundation, director of the Memphis Leadership Foundation and founding director of the Assisi Foundation, among other honors.

WHY GET INVOLVED?

I founded the Mid-South Minority Business Council because we didn't have any organization or agency that fought for Black-owned businesses to get contracts and insurance business. I asked influential businessmen to be on the board—people like the president of First Tennessee Bank, the president of the Memphis Airport Authority, a top executive with International Paper Company, the president of the women's business organization. I was the only person on the board who was Black.

These white executives served with me, and what we were doing was trying to come up with a mechanism so we could get Black business contracts with their companies and do business with them. There is no question that we saw results. My agency never did get a contract through the Mid-South Minority Business Council, but that was not my purpose.

WHAT NEEDS TO CHANGE?

I was on the Minority Contract Committee for the National Insurance Agencies of America for about five years to help get minority businesses into the industry. On the board, we had insurance business owners of all different ethnicities who worked together to get minority businesses into insurance. Today, there are some minority agencies, but still not enough. There’s still racism in the industry.

The insurance business is stressful. If you can't do business with the big "downtown" companies, you can't move forward and help in that area of downtown businesses. For example, the Memphis Convention Center is about to undergo a massive improvement project. If we can get Black agencies some business from that, that would be helpful. We need commercial and trade business—the big contracts. The fact that Black insurance agencies are not awarded those big contracts is still a weakness of the industry.

Photo by Steve Jones