Despite the constant push for people to develop a reasonable plan for a comfortable retirement, procrastination seems to get in the way.

Many Americans are unprepared for retirement. But despite the constant push for people to develop a reasonable plan for a comfortable retirement, procrastination seems to get in the way.

If you want to help your clients develop a plan, start a conversation about their goals and concerns regarding retirement. Sharing credible third-party data often provides a valuable framework for encouraging someone to articulate their outlook on a complex topic.

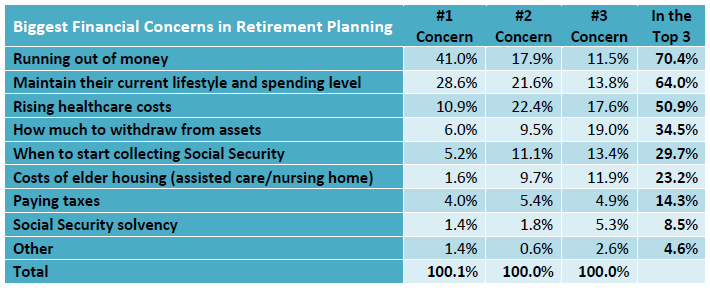

With regard to retirement, a great resource is the 2016 Mid-year AICPA CPA Personal Financial Trends Survey, conducted last July based on 500 responses. As the chart below indicates, the top retirement-related concerns include running out of money, maintaining current lifestyle and spending level, and rising health care costs.

You might expect costs of elder housing to rank higher. Another interesting attitudinal response under concerns about unexpected events during retirement is sharp decline in the value of their investments. But the common thread is obvious: Everyone wants adequate lifetime income.

The responses regarding assisted care/nursing home costs illustrate why agents have difficulty selling long-term care insurance (LTCi). Most people will purchase LTCi if they feel they have adequate retirement income. Therefore, although it’s clear that LTCi can help assure you that assisted living costs don’t become catastrophic, most people won’t purchase it if they feel it leaves them with less than adequate retirement income.

From an agent standpoint, there are two ways to approach the data. Since primary retirement concerns center on adequate lifetime income coupled with the fear of a substantial drop in assets, one approach is offering your clients immediate lifetime annuities. These provide a guaranteed stream of income and can include an inflation adjustment—the right prescription for a meaningful part of a retiree’s assets.

Take 25-35% of the retirement account and purchase a life annuity only—or joint and survivor annuity—at retirement. Alternatively, laddering several lifetime annuities alleviates key concerns, and independent insurance agents are well positioned to get quotes from several carriers.

Another approach that addresses clients’ concerns with assisted living costs is an accumulation annuity with an LTCi rider that allows them to use a portion of the annuities assets for eligible LTC-related expenses. This approach can overcome the objection of paying for LTCi premium separately, and means that if the insured doesn’t need to access LTC benefits, they will have the value of the annuity as a source of retirement income.

Are you passing up the opportunity to have a conversation with both personal and commercial lines clients to help solve their needs? Don’t procrastinate on helping your clients deal with their retirement objectives.

Dave Evans is a certified financial planner and an IA contributor.