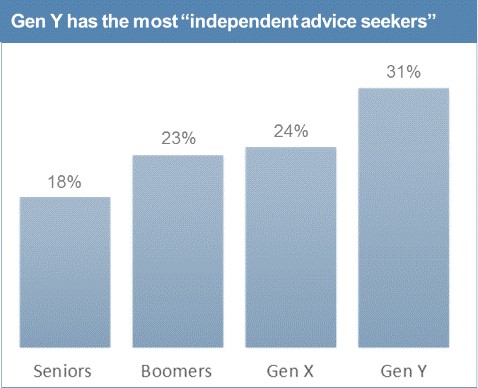

According to a recent study, 31% of Gen Y consumers place themselves in a segment that values independent advice, choice among insurance companies, an expert advocate and ease of understanding their options.

A new day is dawning for the independent agent—and Safeco has the research to prove it.

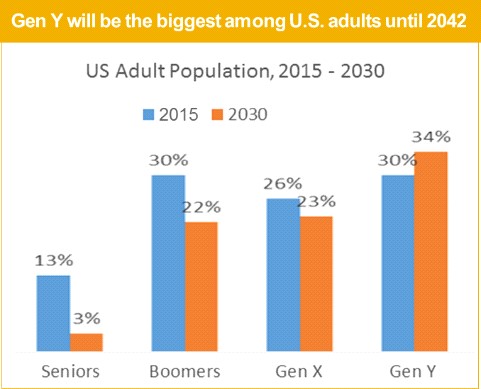

Americans currently aged 19-35—also known as millennials or Generation Y—constitute the only growing generation among U.S. adult consumers. By 2030, they will constitute more than one-third of adults in this country. And they will remain the largest generation until 2042.

The needs and preferences of Gen Y will be important drivers in the insurance marketplace for the next 27 years—the rest of my career and most likely yours, too.

After growing up with digital devices and always-on connectivity, these “digital natives” are generally assumed to prefer online shopping over human contact. But do they really want to buy and manage insurance coverage with their thumbs?

According to a May 2015 research study commissioned by Safeco Insurance, maybe not. The study found that 31% of Gen Y consumers place themselves in a segment that values independent advice, choice among insurance companies, an expert advocate and ease of understanding their insurance options.

The implication? As Gen Y continues to grow into the insurance marketplace, independent agents will see an increase in the share of consumers who prefer their unique value proposition of ease, choice and advice.

Direct-to-consumer carriers often provide easy transactions for pre-packaged products. Comparison websites provide choice between the products of different companies and online transactions. And consumers can get a range of advice and access to online tools through exclusive agents. But only the independent agent offers ease, choice and advice—a unique combination with the power to attract today’s consumers, especially Gen Y.

“Adapting to 21st-century customer expectations” and the “agent of the future” have dominated industry buzz in recent years. But while this kind of conversation is both healthy and useful, the premise has one fundamental problem: “Agent of the future” sounds like someone who hasn’t arrived yet—someone who exists only in our collective imagination.

Meanwhile, agents like Tom Moore and Randy Ahmann of All Lines Insurance in Spokane, Washington are not only thriving in today’s climate but poised to continue excelling as the market evolves. Moore and Ahmann have mastered the rules and tools of engagement—meeting customers where they live (mostly digital, often mobile) with something that is both compelling and meaningful.

Meanwhile, agents like Tom Moore and Randy Ahmann of All Lines Insurance in Spokane, Washington are not only thriving in today’s climate but poised to continue excelling as the market evolves. Moore and Ahmann have mastered the rules and tools of engagement—meeting customers where they live (mostly digital, often mobile) with something that is both compelling and meaningful.

“We’ve had to totally revamp our strategy and come to terms with what’s happening today,” Moore says. “We’re not selling insurance—we’re building relationships. Guide people to make the right decisions and they trust you.”

Countless independent agents like Moore—including 140,000 on TrustedChoice.com—are already offering that unique combination of ease, choice and advice while embracing the new rules and tools of engagement. And that’s great news for the future of the independent agent, because it’s exactly what the rising generation of customers will prefer.

Matthew Nickerson is president of Safeco Insurance.